Education

2021 Leadership College

How Can We Help?

Curious about an educational opportunity? Question about an event? Inquire today.

Contact Us Now

Register Now for 2022 Leadership College

The concept for a chapter-coaching session was developed by management to enhance the skills and leadership abilities of up and coming credit union professionals. Given the growing desire for leadership training and professional development among credit unions, LSCU & Affiliates sees an opportunity to help equip current and future leaders with the skills needed to help advance their credit union careers. The training of this group of employees is designed to ensure the continued success and relevancy of credit unions in the marketplace.

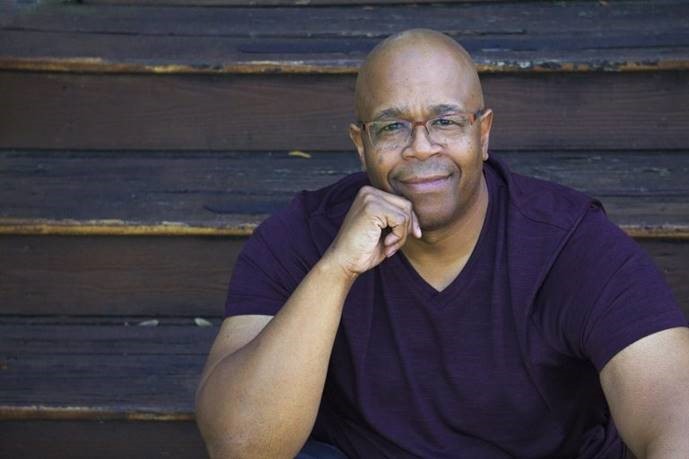

Check out the recording of the 2021 Leadership College Preview Webinar hosted by LSCU and Tony Moore on December 2nd. In this webinar, we discussed the success of the 2020 program, what it’s like to work with and be coached by Tony Moore, and took an in-depth look at what the 2021 program has in store.

Let them know about your interest in learning opportunities

Leadership College trains you on a variety of tangible and intangible competencies including character, culture, coaching, communication, leading change, and execution. The skills can be applied to a wide variety of areas in your job from project management to strengthening your working relationship with peers.

Explain how the training opportunity will benefit your company

The program provides hands-on methods to demonstrate the skills covered in the curriculum in both day-to-day and big-picture operations at your company. You will also have the chance to network with participants from other credit unions, discuss real-case scenarios, and learn proven strategies to show up as a leader in your role every day.

Express your desire for growth

Leadership College focuses not only on professional growth, but also personal growth to align you with values that set you up for success. Expressing your commitment to the company and desire to develop within your role makes your supervisor want to invest in you.

“The leadership program hosted by the League was an amazing experience for my leadership development. Although we were caught in the middle of a pandemic after the first session was held in person, Tony Moore and his team were able to coordinate virtual classroom coaching sessions that allowed the group to continue with the learning experience virtually. Tony Moore is an inspirational leader/coach. I am very grateful for this opportunity and would recommend it to credit unions that believe in providing mentoring and growing opportunities for their employees.“

Kamy Soto, PriorityONE Credit Union of FL

“My coworker and I tell our management often how much we have enjoyed the leadership college and how much we have gained from these sessions with Tony Moore. Tony has a true gift and he is passionate about sharing it – I feel that we need more people like him in this world! When in a class with him, you can’t just sit back and be quiet. He makes you want to speak up which is awesome.”

Felicia Pyle, Community South Credit Union

“Though our classes were altered because of the pandemic, Tony Moore was very flexible with scheduling. The sessions were fun, inspiring, and very interactive - I really enjoyed Tony’s videos as well. If I have the opportunity, I will definitely attend again in the future.”

Emmett Colston, Legacy Community Federal Credit Union

The current structure of the coaching college consists of six, one-day training sessions that take place over the course of a year. Leadership College 2021 Curriculum will cover six topics including:

- Character: Becoming the Leadership People Follow by Choice

- Culture: Building a Culture of Engagement, Ownership, & Bottom-line Performance

- Coaching: Turning Homerun Hitters into Hall of Fame Players

- Communication: Engaging in Difficult Dialogue

- Leading Change: Honoring the Past, Pivoting Towards the Future

- Execution: Harnessing Individual Actions and Collective Power

Mid-level and/or emerging leaders in the credit union movement.

*While we plan to hold one session in-person for each location, we know how unpredictable circumstances are and will adjust accordingly to maintain the health and safety of attendees and venues.

Agenda (EST)

10:00 a.m. - 12:00 p.m.

Lunch Break: 12:00 p.m. - 1:00 p.m.

1:00 p.m. - 4:00 p.m.

Birmingham, AL

(All times in agenda are CST)

In-person location:

Legacy Community Federal Credit Union

100 Corporate Ridge Road

Birmingham, AL 35242

- February 18th (virtual)

- April 15th (virtual)

- June 30th (virtual)

- August 19th (virtual)

- October 21st (virtual)

- December 9th (in-person)

Tampa, FL

In-person location:

Tampa Bay Federal Credit Union

3815 N. Nebraska Avenue

Tampa, FL 33603

- March 4th (virtual)

- April 22nd (virtual)

- June 2nd (virtual)

- August 26th (virtual)

- October 28th (virtual)

- December 16th (in-person)

Atlanta, GA

In-person location:

Atlanta Postal Credit Union

400 Tradeport Boulevard

Suite 401

Atlanta, GA 30354

- February 11th (virtual)

- April 8th (virtual)

- June 24th (virtual)

- August 12th (virtual)

- October 14th (virtual)

- December 2nd (in-person)

Small Asset ($99 Million and under): $1,499

Midsize ($100 Million to $499 Million): $1,999

Large Asset ($500 Million and above): $2,499

*Includes all six sessions

REGISTRATION CLOSED

There is a non-refundable $75 administration fee for registering. All cancellations must be submitted in writing and received by 5:00pm up to two weeks prior to the first Leadership College session per your selected location. Any cancellations submitted less than two weeks prior to your first session will not be eligible for a refund. Enrollment and cancellation of Leadership College encompasses the series as a whole and not individual sessions. Substitutions are always welcome. Please submit cancellations and substitutions in writing to education@lscu.coop.

SAS credit unions ($50 million in assets or less) may apply a portion of their $500 SAS CU Initiative Account to the registration fee for this event or any LSCU or League Service Corporation product and/or service. As LSCU bills your credit union for the events/services used, your credit union can simply write on the invoice that it is to be paid out of your LSCU Small Credit Union Initiative Account. The League’s accounting staff will keep track of the expenditures from your account.

If you would like to utilize Small Asset Sized (SAS) CU Initiative Account funds for this event, please select "check" as your method of payment and contact Judy Scott to complete the process.

The League of Southeastern Credit Unions & Affiliates is committed to providing equal access to all individuals, including those with disabilities, seeking information on our website. If you are unable to access content on this website, have questions about accessibility content or technology used by the LSCU & Affiliates, and/or would like to report barriers to accessing any technology used by the LSCU & Affiliates, including this website, please contact us at webmaster@lscu.coop